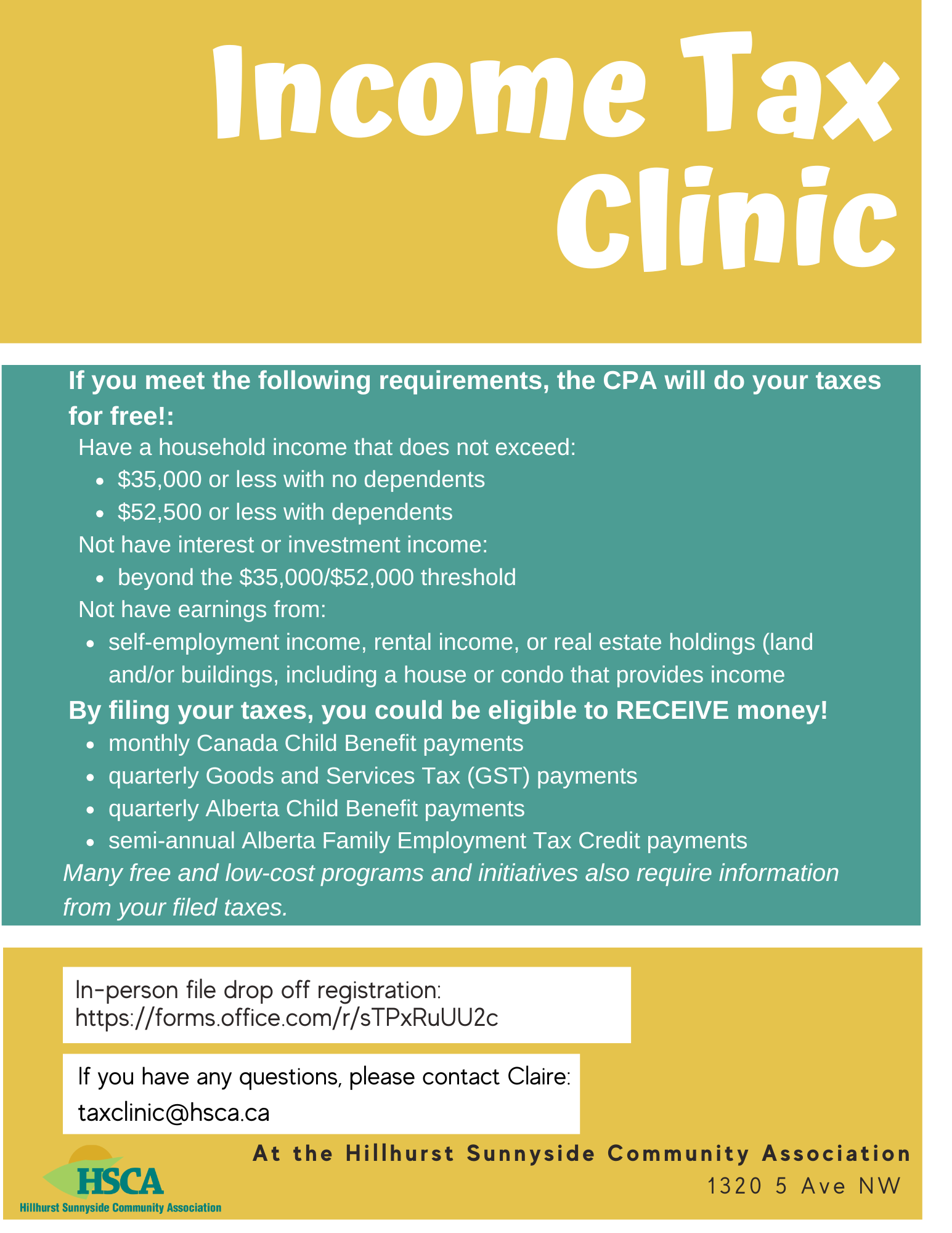

At the Hillhurst Sunnyside Community Association 1320 5 Ave NW.

In-person file drop off registration: https://forms.office.com/r/sTPxRuUU2c.

If you meet the following requirements, the CPA will do your taxes for free!

• Have a household income that does not exceed $35,000 or less with no dependents.

• $52,500 or less with dependents.

• Not have interest or investment income beyond the $35,000/$52,000 threshold.

• Not have earnings from self-employment income, rental income, or real estate holdings (land and/or buildings, including a house or condo that provides income).

By filing your taxes, you could be eligible to receive money!

• Monthly Canada Child Benefit payments quarterly Goods and Services Tax (GST) payments.

• Quarterly Alberta Child Benefit payments.

• Semi-annual Alberta Family Employment Tax Credit payments.

Many free and low-cost programs and initiatives also require information from your filed taxes.

If you have any questions, please contact Claire at [email protected].

Click here to the Hillhurst Community News home page for the latest Hillhurst community updates.

Click here to the Sunnyside Community News home page for the latest Sunnyside community updates.